TurboTax TaxCaster Tax Refund Calculator 2023 - 2024

Tax season offers many challenges for taxpayers. As the new year rolls in, the money rolls out, or at least that's how it is for some of us. Fortunately, the TurboTax TaxCaster tax refund calculator can help you make better financial decisions in order to be prepared for Uncle Sam.

Fact is, it's wise to use the talents of a tax refund calculator continuously throughout the year to see how changes in your life effect your year end tax bill.

The IRS doesn't really care about your budget and how hard it may be at times to cover all the bills that come up in every day life.

Using the TurboTax TaxCaster tax refund calculator to understanding what your up against can enable you to determine what changes need to be made to keep additional cash out of Uncle Sam's pocket, and more in yours.

TurboTax Tax Calculator Checklist

Things you may need in order to get a fairly accurate figure of your refund amount this tax season.

- W-2 form (year-end employer tax statement)

- Your W-9 form (to determine the number of exemptions you declared)

- 401(k), IRA, and other retirement plan statements (including contributions, withdrawals, and penalties you may have been assessed)

- Your capital gains statements for any investments like (stocks, bonds, etc.)

- Unemployment compensation statement

- Your Health Savings Account (HSA) statement

- Medical expenses

- Child-care expenses

- Alimony payments made or received

- Real estate and personal property taxes paid

- Mortgage interest and any points you paid on your mortgage

- Charitable contributions

- Tuition and education expenses

The TurboTax tax calculators estimate what your refund or tax payment will be based solely on the information you enter.

This estimate is not a guarantee of what your tax refund or balance due will be, but it will give you close estimates base on your entries you plug in.

TurboTax Tax Return Calculator

You can use the TurboTax tax refund calculator to calculate the amount of taxes that are due to each of the three taxing entities that make up our total federal taxes. The tax entities include:

- Federal Income Taxes

- Social Security Taxes

- Medicare Taxes

By calculating each of these figures with the calculator above, you can determine how much each of them wants to dig out of your pocket. You can then add all three together to get your total federal income tax liability to the IRS.

TurboTax TaxCaster A Favorite Tax App for 2024

The TurboTax TaxCaster Tax Calculator is a top choice for calculating your 2023 income taxes to be paid, and filed in the spring of 2024.

As one of my favorite year round tax tools, it offers the ability to track your tax liability throughout the year.

This includes registering changes in your life that may dramatically influence the amount of taxes you will owe. Tax breaks and life changes are just a part of that.

This free tax tool is available to anyone regardless of whether you are a TurboTax customer or not.

No fee is required, and no personal identification information is gathered that can identify you. Therefore, you can use this tool anytime, anonymously.

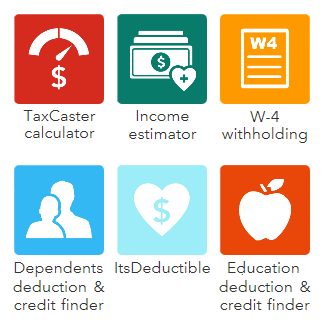

TurboTax Tax Calculator Choices

The TurboTax TaxCaster is available to use online, or as a downloadable Smartphone application for your iPhone, Android, or Windows based Smartphone, depending on which you have.

The big advantage to the Smartphone tax calculator option is that you carry it with you wherever you go. This in turn gives you the ability to record changes that can effect you taxes, when, and where they happen. Say your making a charitable donation to a 501(c)3 organization and you want to record your donation value for tax deduction purposes. You can do that!

Use TaxCaster To Test The Waters On How Changes In Your Life May Effect Your Taxes

Getting marries, having a family, buying a home, changing jobs, going back to school. all these life changes have an effect on your tax brackets and how your tax bill is calculated. TurboTax TaxCaster 2024 Step By Step How To Guide

Several factors come into play when it's time to calculate your taxes.

The

main determining factors include:

The

main determining factors include:

- Filing Status

- Earned Income

- Other Income

- Paycheck Withholdings

- Quarterly Tax Payments

- Deductions

- Exemptions

- Credits

- Dependants and more

With the TurboTax TaxCaster Tax Calculator App you are always ready to record your changes as they happen, anytime, anywhere.

It's a super on the go tax tool that can keep you from forgetting things that could cost you dearly in tax savings.

Plus, that advantage of using this calculator all through the year is that ability to stay informed on what your tax bill will be come year end.

Avoiding a big tax bill surprise is an essential part of keeping the stress level down when tax season creeps up on us.

With the advantage of testing the water for how changes effect your taxes, you can search out opportunities to influence your year end tax bill to your benefit.

This could include big tax deductible savings that can cut your overall tax liability down to size, leaving more cash in your pocket.

TurboTax TaxCaster Displays A Running Balance Of What Your Tax Refund Will Be

A super nice feature of the TurboTax Tax Calculator is the running balance that is displayed as you make changes along the way. Each entry, or change, triggers the app to recalculate - showing you the running balance of what you owe, or what your refund will be.

This happens to double as a great tax planning tool that can help you determine if some of the changes in your life are great moves right now, or if they should be pushed to the following tax year.

Regardless of all the different scenarios you can test for tax purposes, this tax calculator is a great education tool to help you make better financial decisions that can turn out to be a big benefit to your overall tax savings.

Download the TurboTax TaxCaster App today and see how easy it is to stay more informed on your income tax obligations all year round.

Tax tools that make life easier...