TurboTax 2024 Online Support

How big a refund (or payment due) can you expect when you file your taxes this year? The online TurboTax tax refund estimator calculator can help you get an idea where you stand with Uncle Sam...

Tax Refund Status

![]() How

to get your TurboTax 2024 personal refund status information

How

to get your TurboTax 2024 personal refund status information

Go to the Where's My Refund? online tool to check on the status of your refund.

You can generally get information about your refund status within 72 hours after the IRS acknowledges receipt of your e-filed return, or three to four weeks after mailing a paper return.

Check with TurboTax online support, You'll need to provide the following information to access your refund status data:

- Your Social Security Number (or Individual Taxpayer

- Identification Number)

- Your Filing Status

- The exact whole dollar amount of your refund.

TurboTax 2024 online support can help. If your refund was returned by the U.S. Postal Service you may be able to change the address they have on file. Generally, you can file an online claim for a replacement check if it's been more than 28 days from the date that your tax refund was mailed. Where's My Refund? will give detailed information about filing a claim if this situation applies to you.

Checking Your TurboTax 2024 Refund Status

Federal

tax refunds from the Internal Revenue Service (IRS) are generally issued about 2 weeks after

your tax return was e-filed. States refunds vary but can take much longer (New York often delays

issuing refunds until March

Federal

tax refunds from the Internal Revenue Service (IRS) are generally issued about 2 weeks after

your tax return was e-filed. States refunds vary but can take much longer (New York often delays

issuing refunds until March

In general, you should wait 4 weeks if you filed electronically, and 6-10 weeks for a paper filing before contacting the IRS tax authorities.

Be sure to have a copy of your tax return in front of you when you call. You can first try the web or automated phone line. If you're still not able to get the right information, call the number to speak to a live person.

IRS Website: Get Tax Refund Status Online, Automated Refund Hotline: 1-800-829-1954

To speak to a live person:

- Delayed refund or lost refund check, call 1-800-829-0582, extension 462

- For other inquiries, call 1-800-829-1040. First, select option 1 (questions regarding preparing or filing tax return), then select option 5

- Outside the U.S., call (215) 516-2000

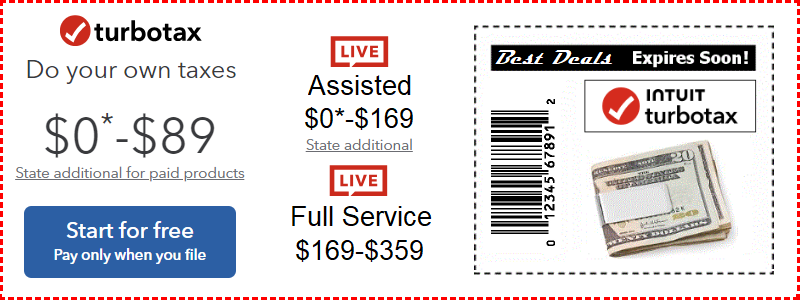

TurboTax

Tax Software is your one stop resource for everything you need to get the most from your

tax refund filing this tax season.

TurboTax

Tax Software is your one stop resource for everything you need to get the most from your

tax refund filing this tax season.

Find the perfect product for your tax return preparation, then file by efile for a quick direct tax refund deposit into your checking or savings account.

We can all get anxious waiting for a tax refund, but when you choose direct deposit, this time of pondering can be much shorter.

More TurboTax 2024 Online Software Perks

- Audit Check: Once you complete your return on the TurboTax website a check will be run to see if there are any errors or any red flags that may arise so that you know your audit risk level and can make corrections. You can choose to pay extra for audit defense as well. If you get audited the audit defense will be provided by a tax professional to represent you and help with IRS communications.

- Maximum Refund Guarantee: If you can find a larger refund using another online tax preparation program, you will be refunded the applicable TurboTax federal and/or state purchase price that you paid.

- 100% Accurate Calculation Guarantee: If you get penalized by the IRS because of a tax return refund calculator mistake made by TurboTax they will pay the penalties and interest resulting from the error.

Getting the right product for your filing needs is the first, and the most important step to insure a stress-less process will be had.

Tax preparation is never a time I look forward to but, it's far better now than it has ever been. Income Tax Software today is so well formatted that it takes all the guess work out and shortens the time needed to complete your return.

TurboTax 2024 online tax preparation is programmed to be quite thorough, as well as easy to use even for complex returns.

How TurboTax Online Guidance Works

Overall, TurboTax is exceptional tax preparation software. If you are planning on using a tax preparation software, you really can’t go wrong with TurboTax. More great features in the full product line include:

- Helps you maximize tax savings.

- Extensive tax resources for complex returns

- Imports financial data from Quicken, Quickbooks, MS Money, and previous year returns.

- Guides you smoothly through an interview process while inserting answers into your tax return.

- Instant access to tax information and advice.

The interview process for TurboTax is so easy and smooth that following the format is as quick and easy as it gets. It fills in the answers you give in the appropriate forms as you complete the questions, then it produces your return with all the necessary schedules.

TurboTax also checks for errors and additional tax savings, then gives you the option of printing and filing a paper return or filing electronically with efile. Efile is the IRS preference for filing and these are processed faster.

Tax explanations of tax regulations are written in simple to understand layman's terms, "not legal mumble jumble" that are well organized and easy to follow. All in all, TurboTax online tax preparation software is the top rated program on the market for completing your return.

IRS trends show that choosing direct deposit is the best way to cut down on the time it take for the IRS to deposit you tax refund into your bank account. Try it!